Living in the moment. Spontaneity. These positive traits associated with ADHD can be downright detrimental when it comes to something that’s front of mind for Americans this time of year: finances. As tax season is in full swing, we asked mental health experts who are well versed in ADHD, as well as financial planning experts, to tell us at Narbis about some potential financial stumbling blocks for people with ADHD, and ways to help people keep focus on their finances.

For people with ADHD common financial pitfalls include impulse shopping and lack of long-term planning or organization. ADHD impacts executive functioning, a set of mental skills that coordinates self-regulation, concentration, planning, and organization. When it comes to finances, it’s common for adults with ADHD to sidestep the issues says Billy Roberts, a mental health therapist and ADHD specialist who works exclusively with adult ADHD and owns a private practice in Columbus, Ohio.

ADHD and impulse spending; overspending

Does your new-found obsession with baking suddenly land you with five new sets of decorative icing nozzles delivered to your doorstep à la Amazon Prime? People with ADHD are often spontaneous. This character trait often manifests itself as the urge to spend, especially on things they find interesting at a given moment.

“This leads to triggering their tendency to overspend and buy things which are out of their budget or beyond their income,” says Alicia Hough, corporate wellness expert with The Product Analyst, a consumer review website. “People with ADHD are often overspending as they feel purchasing outright is the right thing to do, which, technically, is just their way of giving an alibi to their overspending habit brought about by romanticization that material things bring happiness.”

In addition to overspending, many adults with ADHD find it difficult to stick to a budget and often spend impulsively, which can be detrimental to their near and long-term plans, personal budget, and overall financial future. They might be more likely to miss a loan payment or not take as seriously their financial responsibilities, for example, notes Girish Dutt Shukla, a blogger who frequently writes about mental health issues.

Making bad financial decisions can result in debt, and if you’re not good with money management, that debt is only going to grow. Contributing to the cycle, overspending/impulse buying might mean consciously avoiding payments, which in turn causes a snowball effect of anxiety and future financial problems down the road, such as low credit scores and not being able to get a lease on an apartment.

If you find it difficult to track your spending and staying within a certain budget, consider putting money towards a prepaid credit card for discretionary spending like clothes, dining out — or those aforementioned novelty bakeware items.

“If you buy a prepaid credit card for $500 at the beginning of the month, that by default becomes your budget for non-essentials, and will limit the amount you allow yourself to spend,” says Kevin Vieira, senior financial consultant with Bank Rhode Island in North Kingstown, Rhode Island.

Other techniques to help people with ADHD manage their monthly finances better might include cutting out or freezing credit cards. One thing to keep in mind, however, is just like no therapy regimen is one-size-fits all, that money management advice can be different for each individual.

“While one person with ADHD might benefit from a simple savings tool, another might need more extensive and restrictive plans to manage their money better and make ends meet at the end of each month,” says George Birrell, CPA and founder of TaxHub, a virtual tax services firm. “One of the best things that you can do is speak to a professional about managing your finances. This way, the professional can get an idea of who you are and what your financial behavior is like before offering advice that might work best for you.”

ADHD brain? Automate your finances

Saving your money and managing it can be a difficult task for anyone — even more so for people with ADHD. Tasks that are repetitive and require long-term focus like organizing tax receipts or planning a budget can be excruciating.

What makes a tool useful for managing finances depends on the individual. If someone has ADHD, that person’s brain is most likely to respond to creating interesting and clean systems that work for their unique way of thinking and personality. In many cases, this means “offloading” whatever they can that they are outright avoiding, Roberts adds.

Since it can be difficult for people with the condition to stay in the moment, let alone plan for the future, the effort and forethought that needs to be put into budgeting and personal finance can be especially challenging for those who have ADHD. This is why automation can be a lifeline for people with ADHD to keep focused on their long-term financial future.

“Putting systems in place that take direct withdrawals from your checking, like 401(k) contributions, can greatly benefit someone who finds it difficult to keep their finances organized,” says Vieira. “For taxes, someone with ADHD should pay an accountant to get professional tax advice and set up systematic approaches to long-term investing.”

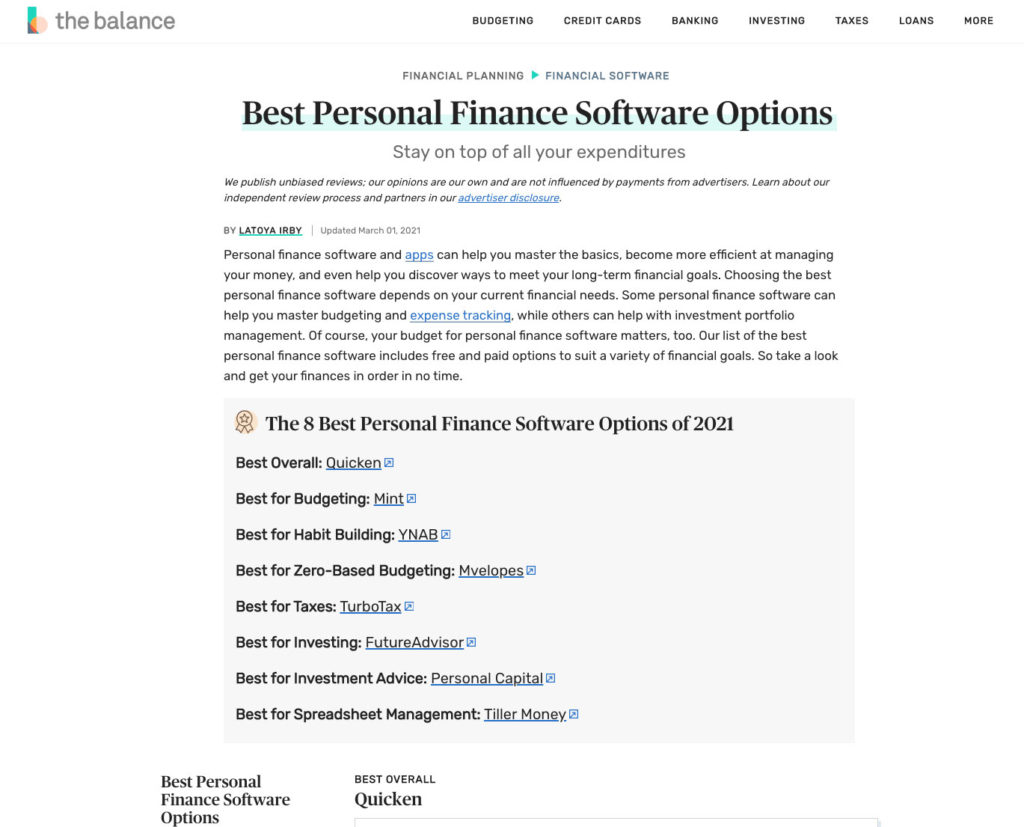

For someone who wants to make a go at harnessing technology to keep organized, using accounting software like QuickBooks to get your finances in order can also be a good starting point. For more options, personal finance site The Balance just put out its list of the “Best Personal Finance Software Options” to stay on top of all your expenditures.

Another resource is YNAB (You Need a Budget), a personal finance app that teaches users to follow certain rules: give every dollar a job, embrace your true expenses, roll with the punches, and age your money.

Michael Hammelburger, CEO at The Bottom Line Group, an expense reduction consulting firm, says the best thing about YNAB is that it helps users create a balanced budget to avoid overspending and also teaches them to save enough money to pay off their debts.

There are multiple ways to help an ADHD brain when it comes to finances

To establish a clear vision about your financial future, it’s important to understand your priorities and interests so that you can save and allocate money accordingly. Yet for someone with ADHD who may only have a vague idea about financial goals, a roadmap might need to be sketched out.

The good news is that there’s no single way to master your financial future. While for some with ADHD, this might be getting an accountant or financial planner; others might find value in software. Speaking with a therapist or an ADHD coach can also help teach new ways of approaching life challenges, including finances, and help alleviate any associated anxiety.

No shame: Finances are difficult to manage even without ADHD

People with ADHD are not the only people who struggle with feeling overwhelmed around tax season, although they do often experience an increased level of shame around any inability to stay organized and focused when it comes to finances.

“Shame as an emotional experience is very familiar to people with ADHD; they often struggle with what they consider to be the basic tasks of ‘adulting’ due to their symptoms. This leads them to have an internal script of “there’s something wrong with me” which is accompanied by the painful experience of shame,” says CPA and mental health counselor, Carrie Potter, CPA, LMHCA, with Sanctuary Psychological Services in Oak Harbor, Wash. “Shame can lead people with ADHD to not want to reveal the depth of their financial struggles and instead, to procrastinate or not acknowledge what might need to be done.”

These feelings of shame can make it a tough task for financial planners and other professionals to help clients with ADHD feel comfortable enough to share their struggles and allow them to make the changes they want to make. (Financial advisors and CPAs please take note: people with ADHD need a judgment-free environment in order to open up to you.)

Living with ADHD doesn’t mean you’re doomed to a life full of regret-buys or a constantly overdrawn checking account. Focusing on long-term financial goals begins with realistic, workable systems. Whether you receive help from professionals or technology, it’s absolutely feasible to create healthy financial habits.

Even with an Amazon Prime account.